Simple Q&A

Let’s Get Started! #

GenAI Studio aims to simplify how you use language models. It is a practical, user-friendly platform that makes it easy for you to test and fine-tune large language models to meet various business needs.

By following these step-by-step instructions, you’ll see how easy it is to create a new project, load a base model, and begin prompting in the playground. With this basic knowledge of the tool, you’ll be able to move on to more advanced topics like creating and fine-tuning a model.

Objectives #

When you have completed this tutorial, you will have:

- Created a project.

- Selected an appropriate foundation model.

- Designed a long-text Q&A prompt.

- Generated output.

GenAI Studio guides you through going from basic prompt design to pretty good model performance. Its built-in guardrails help prevent memory issues and assist you in choosing the right parameters.

Before You Start #

- Sign In.

- Ensure you have properly set your Hugging Face access token.

Create a Project #

We’ll start by creating a new project. Think of it as your workspace for solving the use case and storing your saved model snapshots.

- Navigate to your GenAI Studio home page, and then select Create a new project.

- Name it

Simple Q&Aand then select Create. You’ll see the new project in your project list. - Select Simple Q&A from the project list.

Next we’ll set up a playground and choose a base model.

Choose a Base Model #

Now that your project is set up, we’ll select a base model, providing the foundation for our classification task. Visit the glossary to find out more about foundation models.

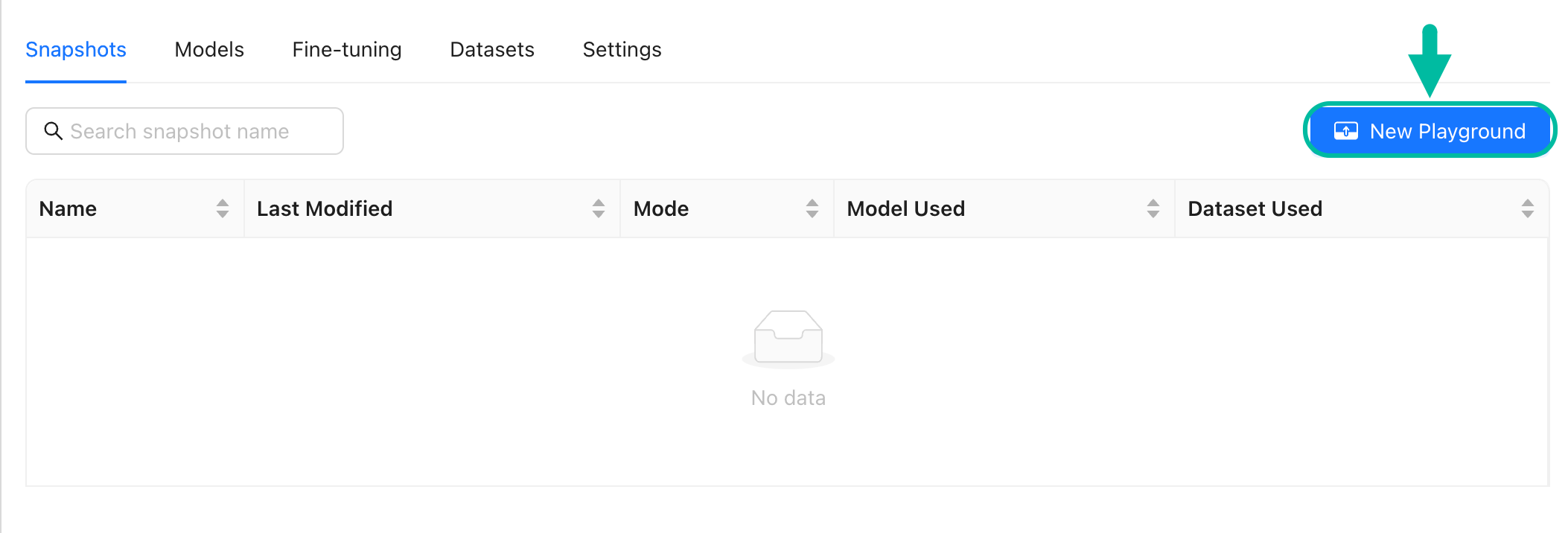

- From the project’s Snapshots tab, select New Playground.

- In Select model, choose a chat model such as

meta-llama/Llama-2-7b-chat-hf. - Select a Resource pool. Let’s choose the

a100resource pool of NVIDIA A100s. NVIDIA A100s are generally recommended for inference and fine-tuning However, if your resources are limited, you can use NVIDIA V100s or NVIDIA T4s. - Select Load to load the model into the playground.

Provide Instructions #

The playground is all set up! Now it’s time to give instructions to the model. We’ll prompt the model with a question and ask it to respond in bullet-point format. After generating a response, we’ll save our progress as snapshot1.

- Type the following Instruction.

Instruction

Answer the provided question using bullet points.

Step-by-Step Instructions: How To Remove Dispute Wording Our experience has been that in many cases, borrowers can successfully remove dispute wording from their credit reports quickly and without much difficulty. Before starting to remove dispute wording, you need to know the following information for each disputed account: That the account does, for sure, does have to have dispute wording removed. Which credit bureaus show the account as disputed. That removing the dispute wording will not lower your FICO scores below the minimum you need to qualify for the mortgage. First: Remove Dispute Wording from the Data Furnisher’s File Call the Data Furnisher, the creditor for the account, and ask them if your account is in dispute in their system. If your account is disputed in the Creditor’s system, tell the creditor representative: You are in the process of getting a mortgage and the dispute wording on this account is preventing your loan approval. You no longer dispute any information on the account. You agree with the balance and the prior paying history on the account. Make a note of the date, time and the person you talked to. Do not agree to do anything in return for their removal of the dispute wording (see below). Follow up by calling the creditor again after two or three days to verify that the account is no longer in dispute in their files. If a Collection Agency Demands Something in Return for Removing Dispute Wording We have experienced collection agencies asking for payment or some other consideration for removing dispute wording. This triggers our procedure for legal action. You should know that a third party collector (not the original creditor on the account) is prohibited from this by law (Fair Debt Collection Practices Act ). Second: Remove Dispute Wording at the Credit Bureau Level Regardless of the account’s dispute status in the creditor files, you should verify that dispute wording in removed at the bureau level. The fastest way to do this is by telephone. Obtain a credit report directly from that bureau. Other online reports will not work. You can get these free bureau reports from Annual Credit Report. When going here, you have to take your time, there are four security questions that you cannot miss, or the report is by mail only. On the first page of each report a file number or report ID, along with a phone number to call each bureau. Make sure the account is in dispute (see above). Call the phone number on the report. The file number or report ID will get you to a human so they can pull up the account in dispute. Tell them you no longer dispute the account and agree with the balance and prior paying history, furthermore need the dispute wording removed as it is preventing mortgage loan approval. Now that both the Data Furnisher and the bureaus are on notice and working on your dispute removal, you will want to monitor your credit file. For this we recommend the FICO Ultimate 3B. Also note that when each reporting agency completes the process for you they will communicate via mail, or email if you gave them your email address in the phone call. Once the dispute wording is removed from all reporting agencies, it is time to go back to your lender to continue with your loan process. Provide a Question #

- In Input, provide the model with questions.

Input

Question: How can customers' disputes be removed from the credit report in 50 words or less?

Answer:

Question: What will happen after the dispute is resolved, within 50 words?

Answer:Generate a Response #

- Select Generate.

- Review the generated output.

- Select Save Snapshot and type a name like

snapshot1.

What’s Next? #

Getting to the desired response is part science and part art. Trial and error. In the examples section, you’ll find tutorials for learning about ways for improving the model’s response.

- Visit the Tutorials section to continue your learning journey.